Top-3 Takeaway: Key Roles in a Transaction

There are many key players that help a transaction get to closing. The FOCUS on NoVA Real Estate team explains who they are and what they do. Contact the FOCUS on NoVA Real Estate team today for more information.

Every industry has their jargon, their lingo, and because I am in it every day, I’m going to throw those terms around thinking everybody else does too. Every now and then it’s nice to pause and define who are the people that you’re going to be talking to and that are going to be involved in the transaction as you go to sell or buy a home.

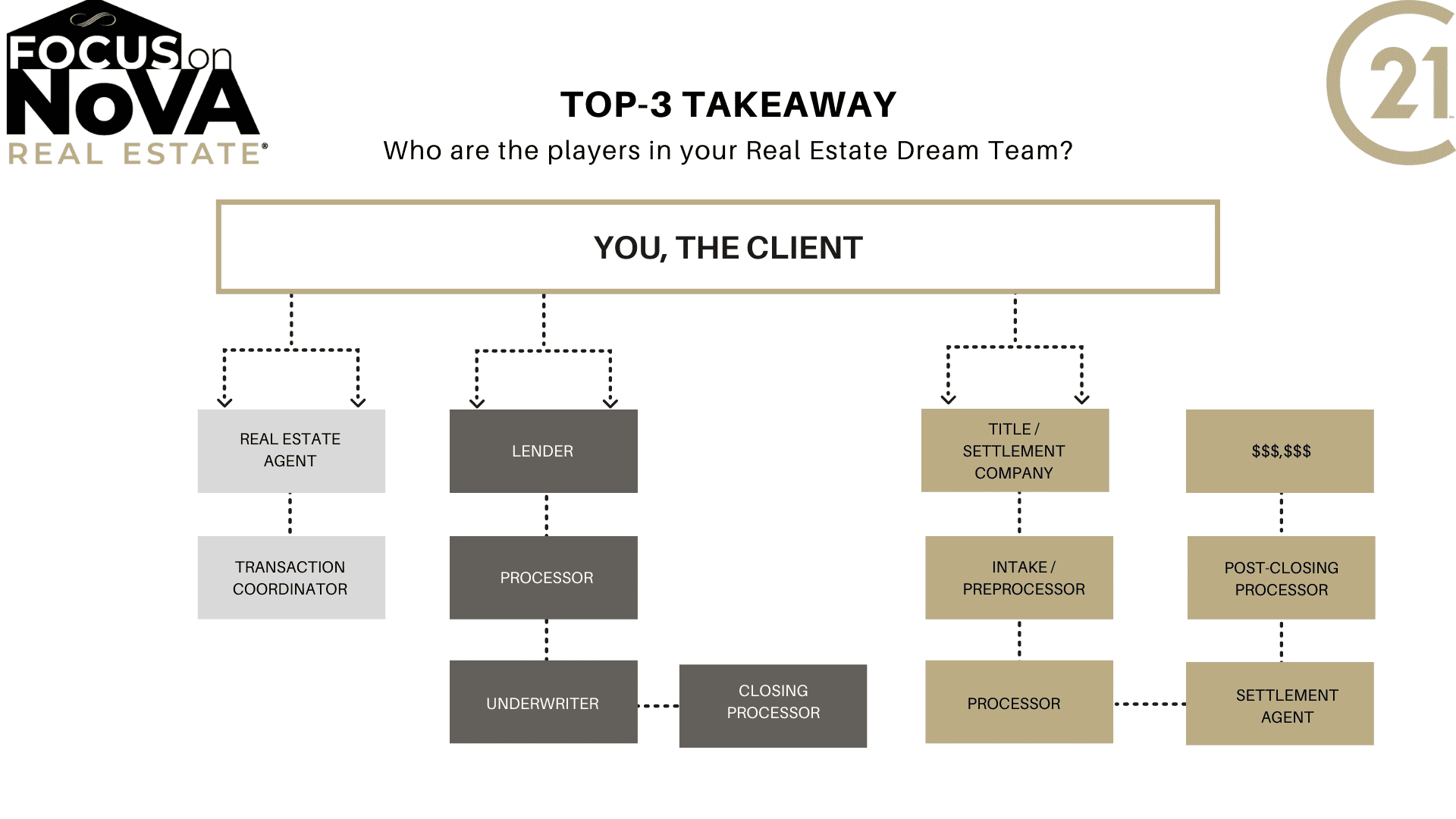

It can get quite complicated once you actually get involved with the transaction. So we’re going to take a look at the top three takeaway. Who’s leading the charge? It’s you!

You are the client and you are in charge. You’re going to have three players in general, or at least categories of people, that are going to be helping you out.

- First and foremost is your real estate agent. As your real estate agent or broker we’re going to help you gather everything stay on track. I personally use a transaction coordinator who helps us get the documents, collect the documents, hit our timelines, and disperse things as we go forward. She’s making sure that in the background we’re going to stay on track.

- The second person on your team is your lender. You’ve got to have a good relationship with your lender. Your lender is going to be the one that’s counseling you on financial matters, what your down payment will be, your cash to close, as well as what your monthly mortgage will be. Plus you should work with them because there’s tons of loan products and one of them is your “cinderella slipper”. So in the lender situation they’re usually going to have a processor. Once we find your property and we go under contract, we send that to the lender, the loan officer, will then kick it down to their processor and now you’re going to start collecting all kinds of data and information. Once they’ve collected your entire loan application package that will then go to their underwriter. Now the underwriter is the one that carries the power. They collected the best package they can by communicating with you closely. They send it to the underwriter, and the underwriter is the one that decides whether or not you’re qualified for your loan. Typically there’s usually a couple of outlying things that they need clarification, they’ll kick it back up to the processor who will let your lender know. Your loan officer will give you a ring or an email, you’ll send back some paperwork and it will go back through underwriting. Once the underwriter says you’re good to go, it’ll go to your closing processor who puts all the documents together to get you to closing.

- So the third part of the transaction is your title company. As a seller your title is the one that’s going to ultimately end up preparing the deed and making sure everything gets recorded and you get paid. So these people are who we’re going to be talking to. The purchaser, on the other hand, is probably going to have a little bit more relationship with the title company as they move through their process because they’ve got more going on with the loan. So from the title company when we first ratify a contract and everybody’s come to terms, we’re going to get that into the intake and preprocessor. There’s going to be an information sheet that goes to the seller, and one that goes to the buyer. All of that information is collected and then given to the processor. The processor begins the process of ordering the title bring down to make sure that it’s clear that there’s no issues and, if there are issues, that processor is going to work with the seller to clear them up. In the meantime the processor is going to work with the lender, the buyer’s lender, very closely to make sure all the loan documents are coming in in a timely fashion. In addition to that they’re going to work with the seller to make sure if there’s a mortgage on the property that the payoff is ordered and everything’s ready to go for when we get to closing. Once we’re ready to go to closing the lender will send the processor and the settlement agent the lender documents. We will all go to closing the seller will sign, and the buyer will sign everything. That loan package goes back to the bank where the bank will then release the funds for everything to happen, and it will go into the post closing processors hands. This person here will take the time to get it to the courthouse within two days of closing to record the purchase of the property. They will also make sure that once it’s recorded, all of the proceeds and various folks that need to be paid, are sent out and disbursed. And that’s when the transaction is finished.

So these are the roles within your transaction: your real estate agent, your lender and your title company, and the names and people and their roles that you’re here throughout your transaction. If you have any other questions about this process in general and you’re looking to either buy or sell real estate contact the FOCUS on NoVA team today